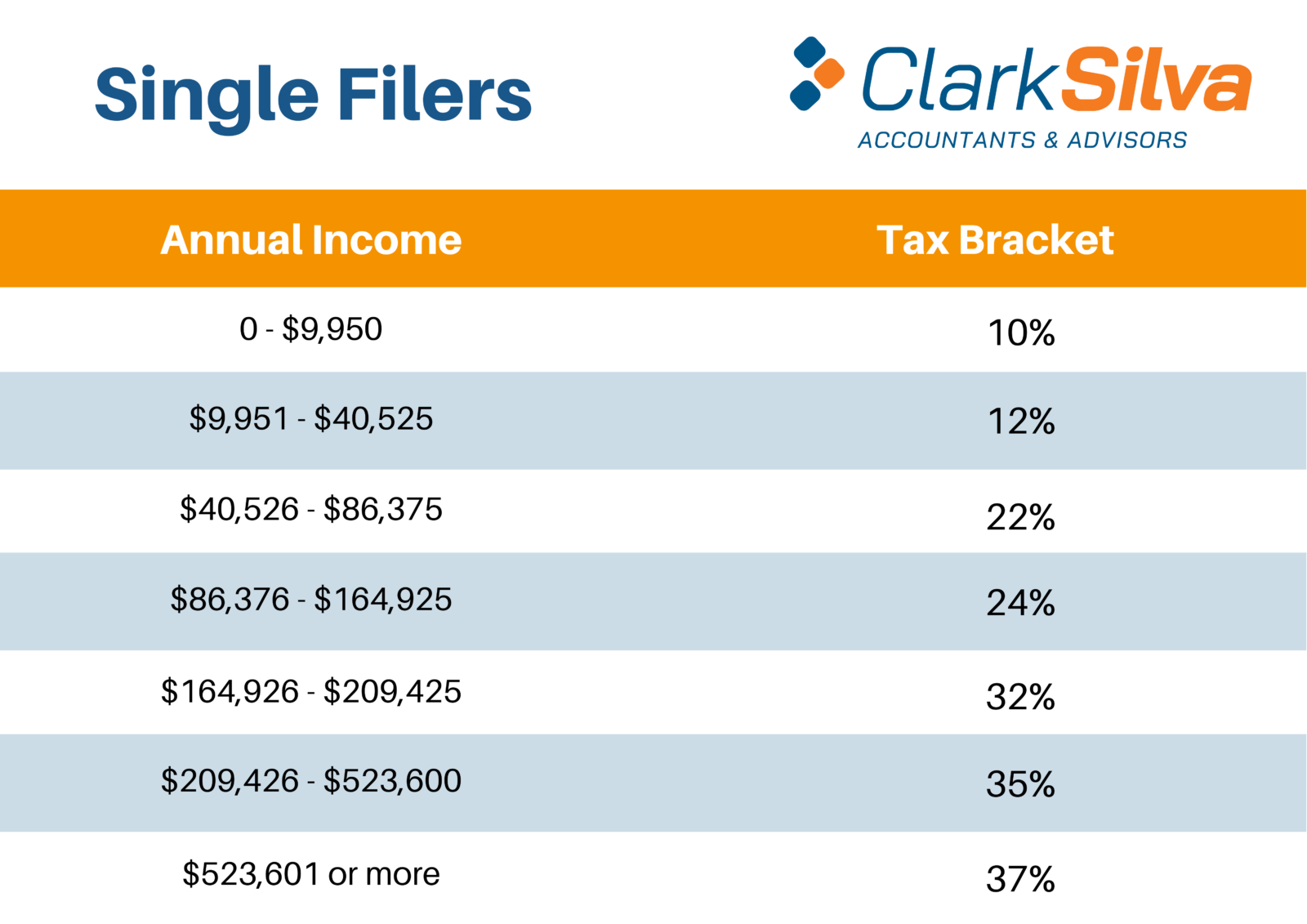

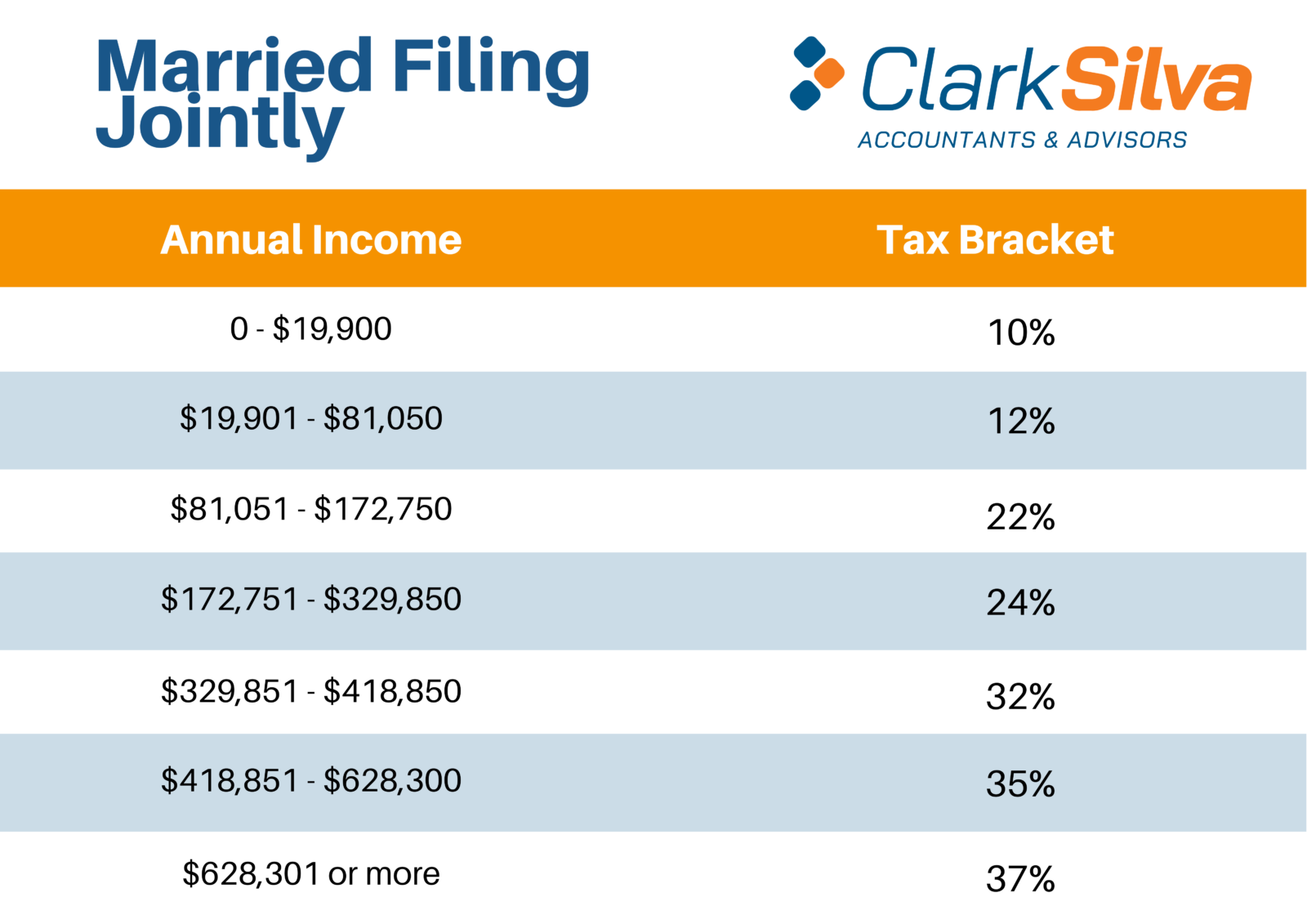

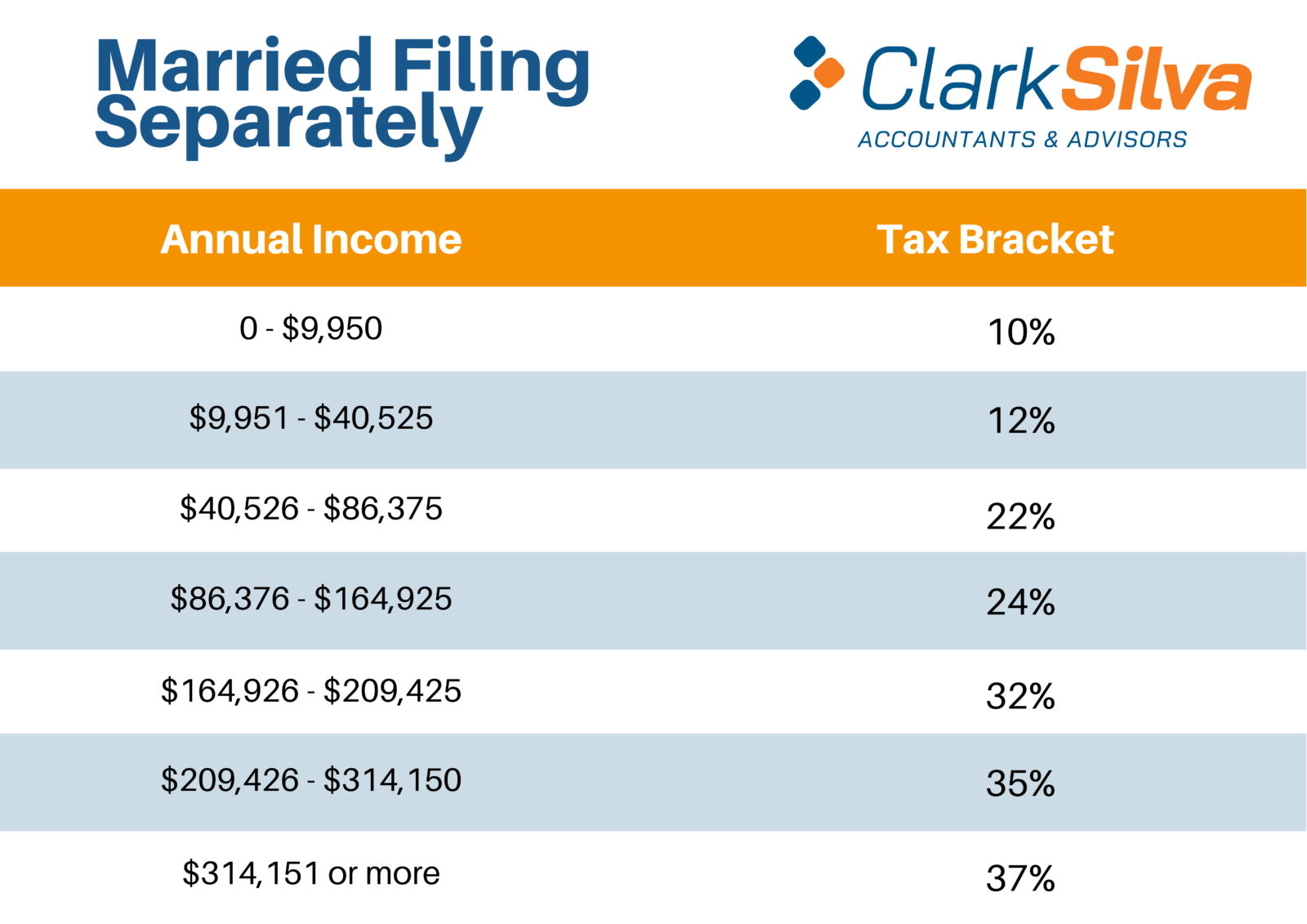

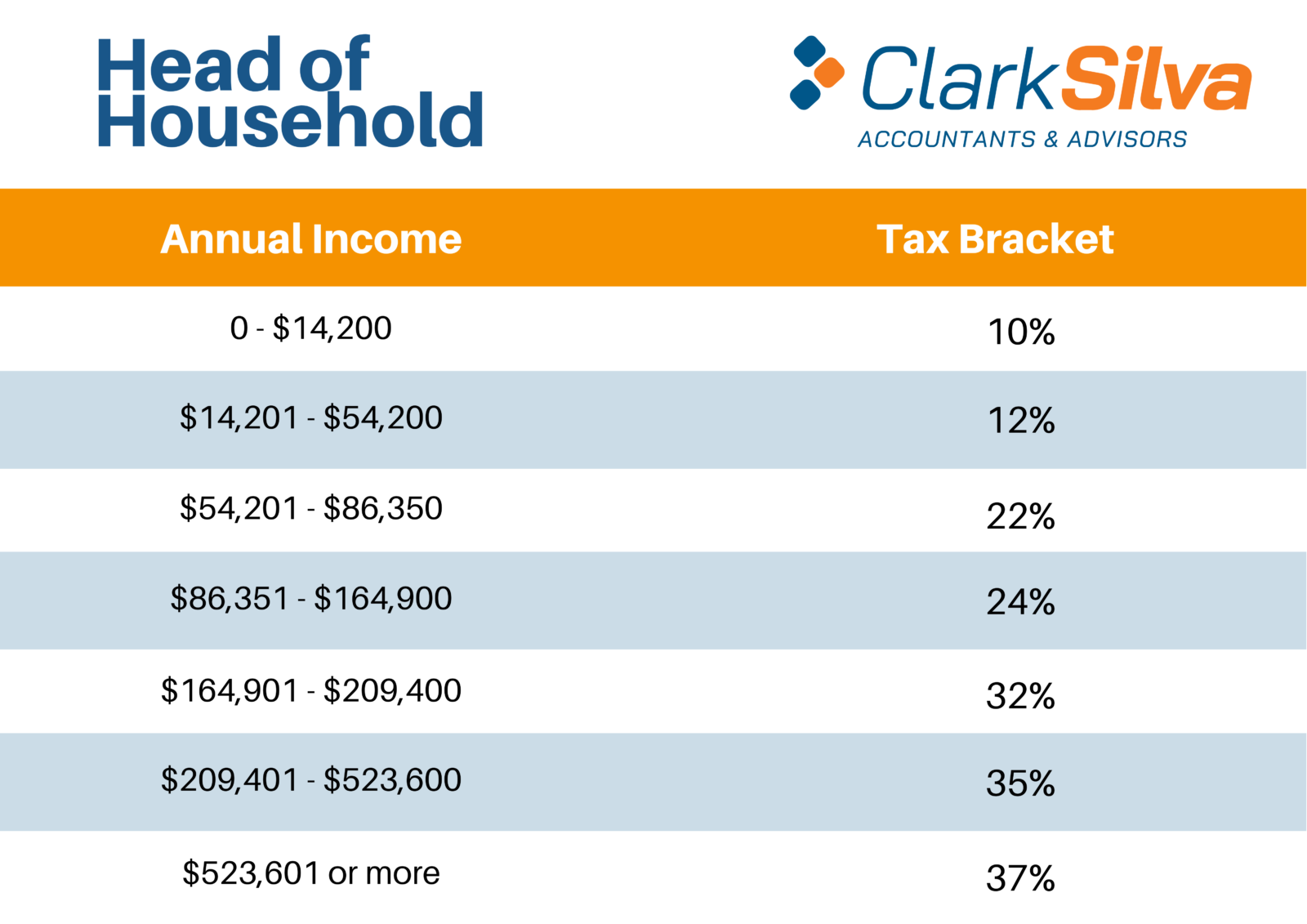

Tax rates haven’t changed since 2018, however, the IRS updates the income brackets annually for inflation. Since tax planning is all about thinking ahead, now’s the opportunity to start planning on how to handle your 2021 finances, in anticipation of filing returns in 2022.

Taxpayers will fall into one of seven brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%, indexed to keep pace with cost-of-living adjustments. These brackets are marginal, which means that different portions of your income, up to a specified dollar amount, will be taxed at a different rate.

Want to make sure you start 2021 on the right track? Give us a call; we’re here to answer questions and make suggestions.

Stay In Touch